Developing a Rock Solid and Compliant Discounting Policy

Posted on October 23, 2018 by Holly Jensen

We often hear of chiropractors and other health care providers offering a “cash fee” for services. Or in other words, a “discounted fee” for cash paying patients. There is a lot of confusion around this topic and we hope to create some clarity with the following.

In the healthcare world, you have to be aware that there are licensing boards, State Laws, Federal Laws and Federal Agencies who set rules and regulations that you must follow. In this article, we will explain how to develop a rock solid and compliant discounting policy that should keep you compliant.

First, let’s understand something….there is no such thing as a cash fee or insurance fee. You have one fee for the service and it’s discounted based upon the patient’s circumstances and the discount rule being applied.

Let me repeat this. There is no such thing as a cash fee. Let that sink in. You only have one fee for a service.

And your response is, “Wait, but I have a different fee for this or that insurance, Medicare, personal injury or cash patients. I mean when I do Medicare, I get paid one fee and when I do insurance I get paid another fee.”

You don’t have different fees. You have different reimbursed amounts. In other words, what you have are different discounts applied to your fee. Again, let me repeat, you have different discounts that get applied to your fee.

The question becomes, what discounts are you allowed to offer and not violate any of the rules and regulations mentioned above.

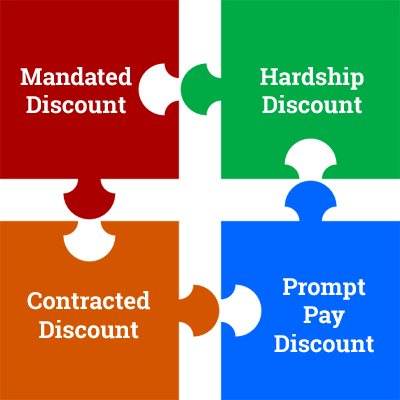

The only time you offer a discount is when it is:

- Required by Mandate

- Documented Hardship

- Contractual Agreement

- Prompt Pay

Each of these four compliant discounts has their own set of rules. If the discount you are offering doesn’t fall within one of the four types, it is likely not a compliant discount. Please notice, there is no “Cash Discount” among the four types.

Let’s review each and what they require.

Required by Mandate:

If the patient is covered by a State or Federal program with a mandated fee schedule. (Medicare, Medicaid, etc)

When patients are receiving a mandated discount (i.e. Medicare), in essence, you are agreeing to accept what they reimburse by treating the patient. For example, if your fee is $55 for a service and Medicare’s allowed amount is $35, you have not agreed to charge $35 you have agreed to discount your $55 service by $20.

Documented Hardship:

Patients who meet state and or federal poverty guidelines or other special circumstances outlined in your “Hardship Policy” may be offered a discount for a period of time as determined by the clinic. Verification of hardship status is required. Lastly, no more than 5% of your patient base population should be on hardship.

Note, you cannot define someone as “hardship” simply because they are cash patients. This is important as we have seen examples where doctors say they use hardship discounts for all cash patients. This is not a compliant practice.

Contractual Agreement:

If you are a participating provider in the patient’s health insurance plan.

If you are a member of a Discount Medical Plan Organization (DMPO) the patient will be entitled to network discounts similar to your insured patients.

Like mandated discounts, you are agreeing to accept what the insurance company or DMPO allow by treating the patient. For example, if your fee is $55 for a service and the insurance company or DMPO allowed amount is $35, you have not agreed to charge $35 you have agreed to discount your $55 service by $20.

Prompt Pay:

You can offer patients a discount on non-covered services (i.e. cash services) when they pay for services promptly. The clinic can define what “promptly” means. For example, you may define it as “payment on the same day or prior to when the service is provided.” Or, “within the same week or month, the service is provided. Or, “within # days of service being provided.”

The limitation of how large of a discount is defined by the OIG (Office of Inspector General) Department of Health and Human Services.

In 2009, they rendered an opinion letter (https://oig.hhs.gov/fraud/docs/advisoryopinions/2008/advopn08-03a.pdf) basically saying that a prompt pay discount can be provided and should be between 5% – 15%.

It is for this reason, we recommend you limit your prompt pay discount to 15% or less. In practice, this means, for NON-COVERED services, you could apply a discount up to 15% when the service qualifies for your definition of a prompt pay discount.

In summary, for all patients, the non-covered services (i.e. cash paid services) are the ONLY ones that can be discounted with a prompt pay discount.